What is an Estate Plan?

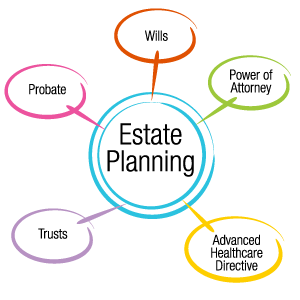

A “comprehensive estate plan” includes a trust, will, durable power of attorney for management of property and personal affairs and an advance health care directive (also known as a living will). Estate plans enable you to do the following:

- Plan for your incapacity. Executing a durable power of attorney for management of property and personal affairs enables you, while you have capacity, to nominate individuals you trust to act on your behalf in the event of future incapacity (e.g., car accident, dementia, etc.). During your incapacity, which may be temporary or permanent, your attorney in fact will have several powers, including but not limited to, the power to file your federal and state income taxes, file a lawsuit on your behalf (which may be the cause of your incapacity), inherit on your behalf, ensure your health care premiums are paid (to ensure you do not lose your existing health care coverage), fund your trust by titling non-trust assets into the name of your trust to avoid probate.

- Nominate individuals to make your health care decisions when you are unable to make them. Executing an advance health care directive, also known as a living will, enables you, while you have capacity, to nominate individuals you trust to act on your behalf to make your health care decisions. This document enables you to specify certain health care wishes in advance (e.g., your burial preference (burial or cremation), anatomical gift preference (donate organs and tissues for transplant purposes or donate your body as a cadaver or only donate organs and tissues to family members or no anatomical donations), life sustaining treatment preference (do you want to be on life support if you are in a permanent vegetative state, have no brain activity or are terminally ill and life sustaining treatment is only prolonging your death). Any and all decisions you do not specify in this document, your health care agent will have the discretion to make.

- Execute and fund a trust. There are multiple reasons to execute a trust. Some of the reasons include, giving your successor trustee the power to manage and control your trust assets if you are incapacitated, probate avoidance, and estate tax avoidance. Probate is the judicially supervised process of a judge supervising the changing of title from your name to your beneficiary’s name upon your death. Probate is typically a slow process and typically takes between nine months to two years to complete. Court fees and filing fees are hundreds of dollars. Attorney fees are based on the gross value of your assets. For example, if you purchased a home that is not titled in the name of a trust, it will go through probate. An attorney is paid between 1 to 5% of the gross value of the home depending upon the size of your estate. If you purchased a home for $500,000 and had no equitable interest in the home, an attorney may be paid up to $20,000 in fees in probate to change title of the home. Alternatively, if your home was titled in the name of a trust, your successor trustee would pay between $10 to $30 to change title. Probate should always be avoided whenever you own real property due to these unnecessary expenses.