Financial / Retirement Planning

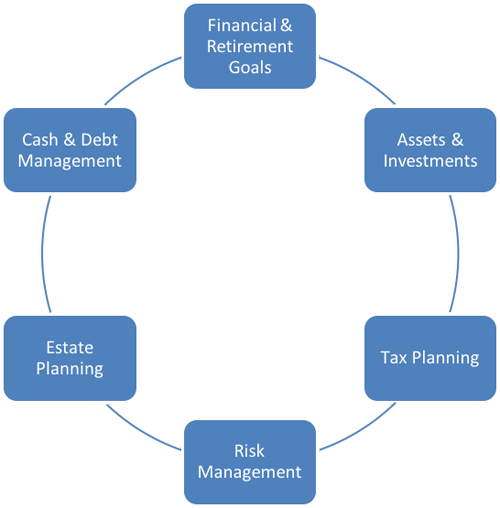

Financial planning consists of six main areas. Changes in one area often affect other areas. It is imperative to work with a CFP® professional who understands how to build a coordinated financial plan.

Click here to see what each area entails.

|

Financial & Retirement Goals

|

Assets & Investments:

|

|

Tax Planning:

|

Cash & Debt Management:

|

|

Estate Planning:

|

Risk Management:

|

Our financial plans are about quality, not quantity. You will not be handed a 50-page spiral-bound “plan” full of boilerplate language with confusing numbers and line graphs. We provide a Recommendations Report, which simply provides specific recommendations and details about what you need to do and when in each planning area. You are encouraged to track your progress through periodic or annual review meetings.

Continue to our Financial Planning services.