"Big Picture" Retirement Review

A 30-minute exercise with a CFP® Professional exploring your “big picture” retirement goals and the relationship each of the following factors might have in your success.

Pre-Retirement

- Annual savings rate

- Years to retirement

- Retirement savings goals

- Portfolio allocations

- Portfolio expenses

- Confidence levels

Retirement

- Monthly spending and withdrawal rates

- Years of retirement

- Legacy capital

- Portfolio allocations

- Portfolio expenses

- Confidence levels

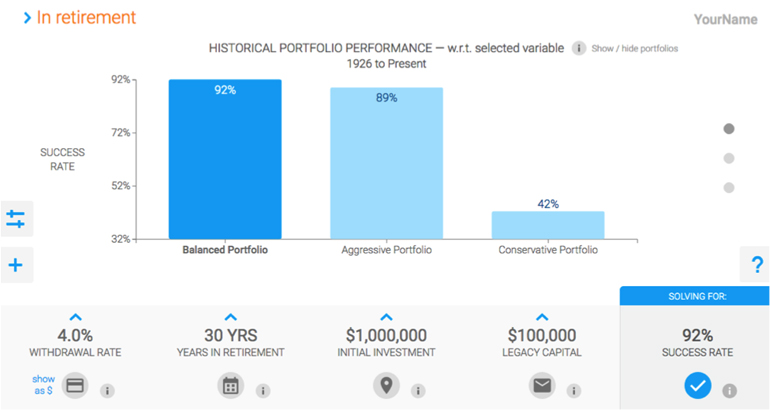

We’re essentially taking your high-level goals and running them through multiple “what if” scenarios based on historical market data (1926 – present).

Let’s say you’re about to retire. You have a $1,000,000 invested in a 50% stock portfolio with a 1.20% expense ratio. You want to withdraw 4%/year and still have $100,000 remaining after 30 years. We could show you that your historical confidence level was 73%. That means that out of the 730+ rolling 30-year periods since 1926, you accomplished your goal in 73% of the periods.

Then we can explore the various factors. There are numerous ways to view the data, but here are a few.

|

In this example, if you: |

Than your confidence level changes to: |

|

Lower your expense ratio to 0.80% |

82% |

|

Lower your withdrawal rate to 3.7% |

85% |

|

Lower your time frame to 28 years |

80% |

|

Lower your legacy capital to $50,000 |

78% |

|

Increase your portfolio to 60% stocks |

84% |

|

Combination of the first 2 |

93% |

We can solve for any factor or combination of factors.

- How large of a portfolio do I need in order to withdraw $60,000/year from it for 25 years and still have a 90% confidence level?

- Has an allocation of 30% stocks or 50% stocks historically worked better for my situation?

- How much can I withdraw from my portfolio over 27 years and maintain a 95% confidence level.

It can be helpful for people who are still 20 years away from retirement as well. Once we narrow down your high-level retirement goals, we can explore how changing your savings rate, years to retirement, allocation, and expenses can all impact your confidence levels.

Cost: $99